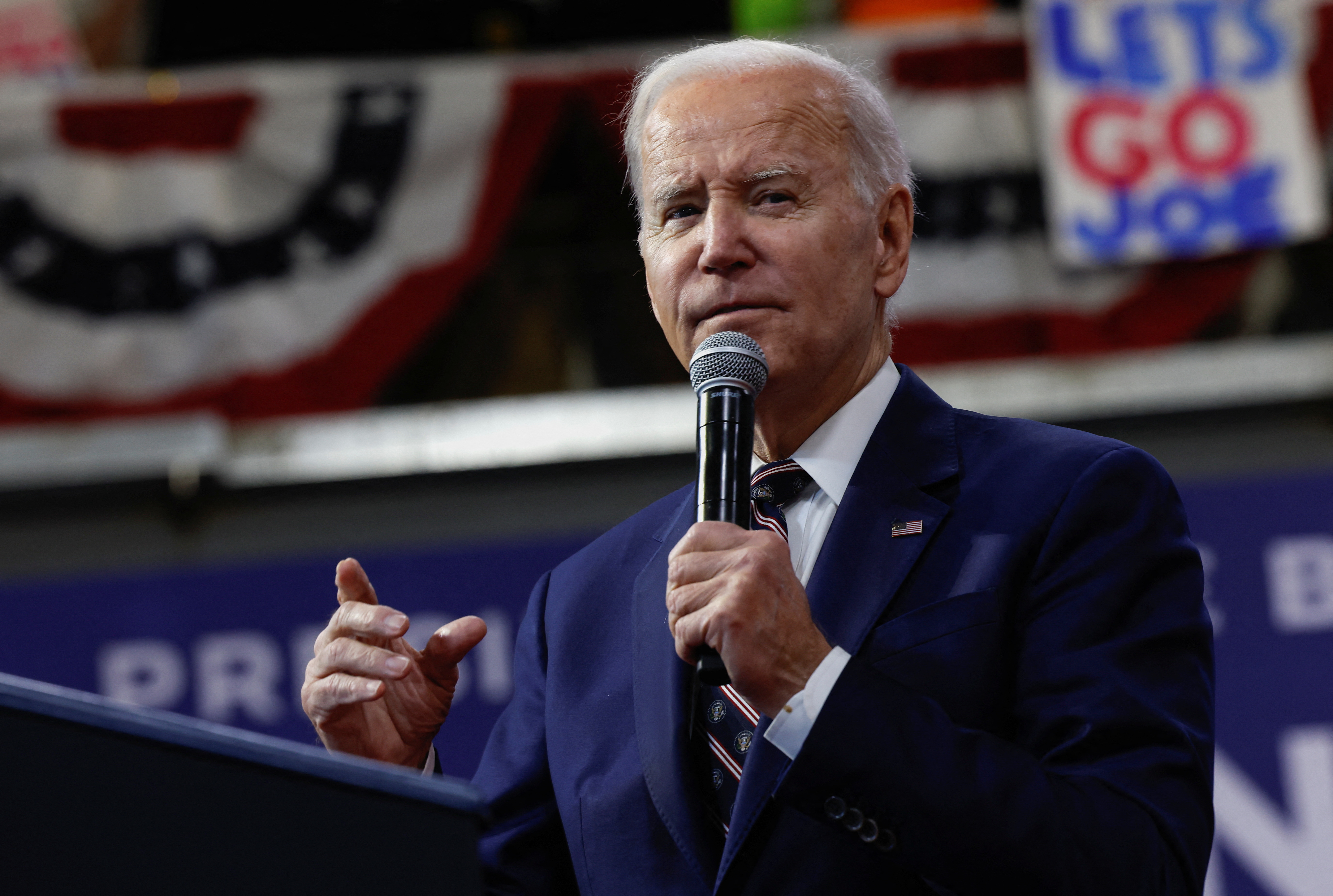

What is the Stepped-Up Basis, and Why Does the Biden Administration Want to Eliminate It?

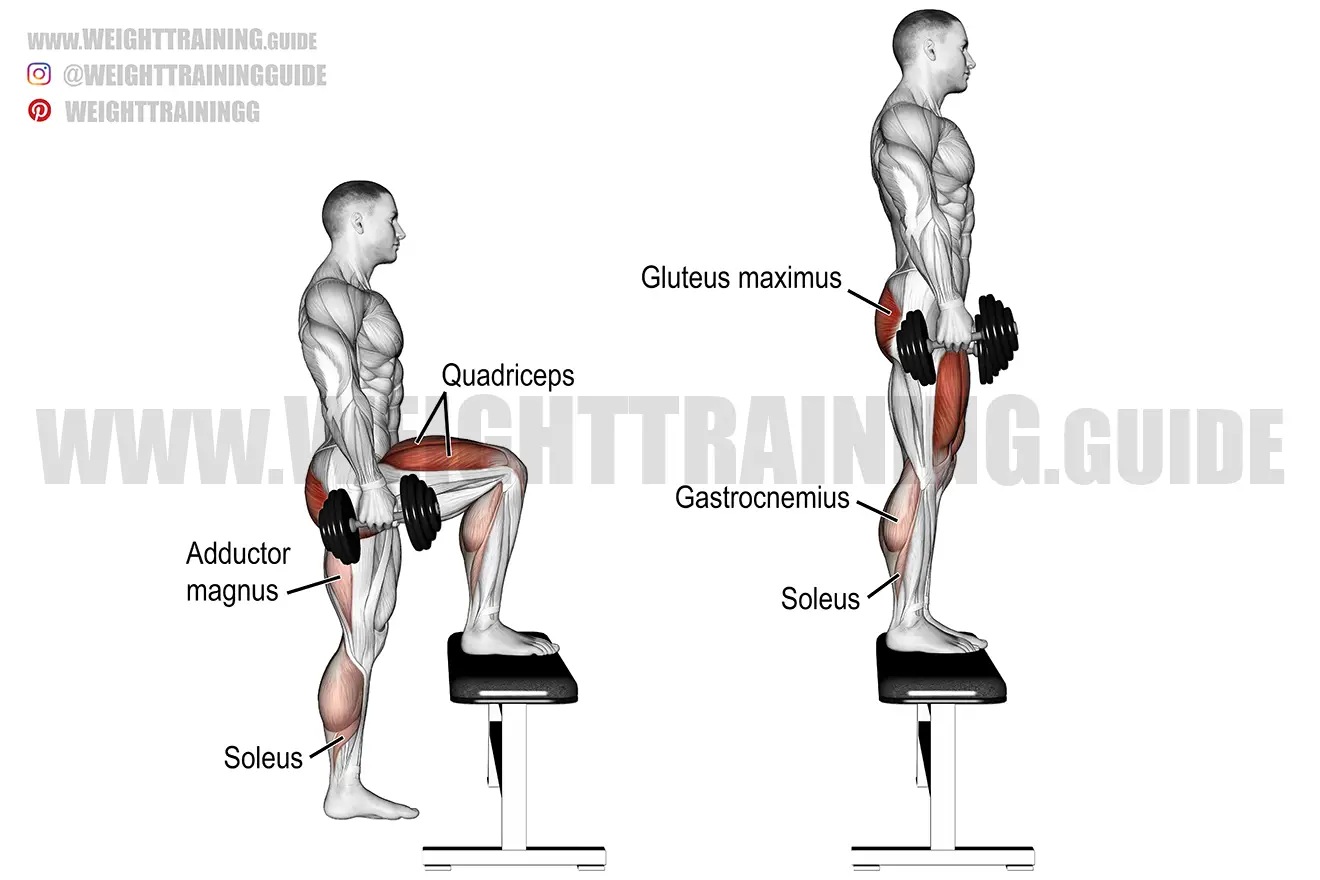

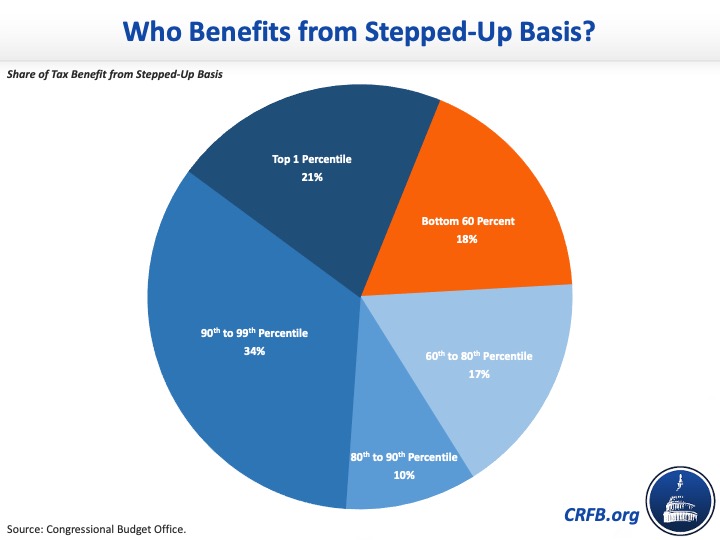

The step-up in basis is a provision in tax law that relates to how assets — such as stocks, bonds, or real estate — are valued and taxed after their owner passes away.

Closing the Stepped-Up Basis Loophole-2021-09-09

3 Reasons I Disagree With Biden On The Step-Up In Basis (But Support His Other Tax Proposals)

Inside the $40-billion-a-year tax 'loophole' Biden's plan would eliminate

Economic policy of the Joe Biden administration - Wikipedia

2022 Tax Reform and Charitable Giving

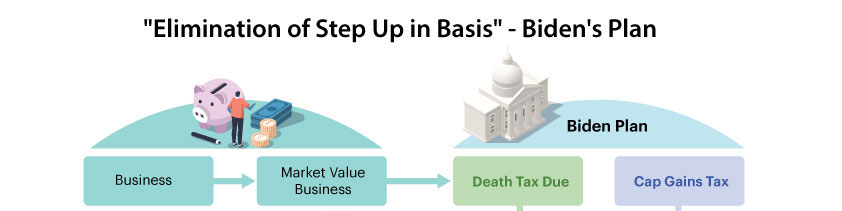

Warning; Elimination of Step Up in Basis could destroy your business! - Policy and Taxation Group

Revenue-Raising Proposals in President Biden's Fiscal Year 2024 Budget Plan – ITEP

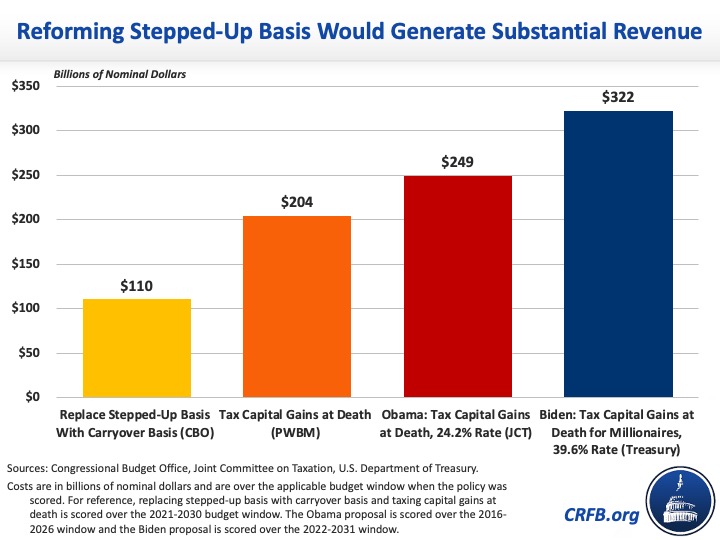

Closing the Stepped-Up Basis Loophole-2021-09-09

The Boomer death tax – Daily Breeze

Biden administration set to ask Congress for additional funding for Ukraine, Covid, and disaster recovery

The Huge Tax Break for Home Sellers: What to Know About the $500,000 Exemption - WSJ

House approves impeachment inquiry into President Biden as Republicans rally behind investigation - WHYY

Biden vows new bank rules after SVB collapse, cites Trump rollback