OECD's Pillar One Blueprint: Revenue Sourcing Rules

OECD's Pillar One Blueprint: Nexus for Purposes of Amount A

A Practical Proposal to end Corporate Tax Abuse: METR, a Minimum Effective Tax Rate for Multinationals - Cobham - 2022 - Global Policy - Wiley Online Library

NishithDesai

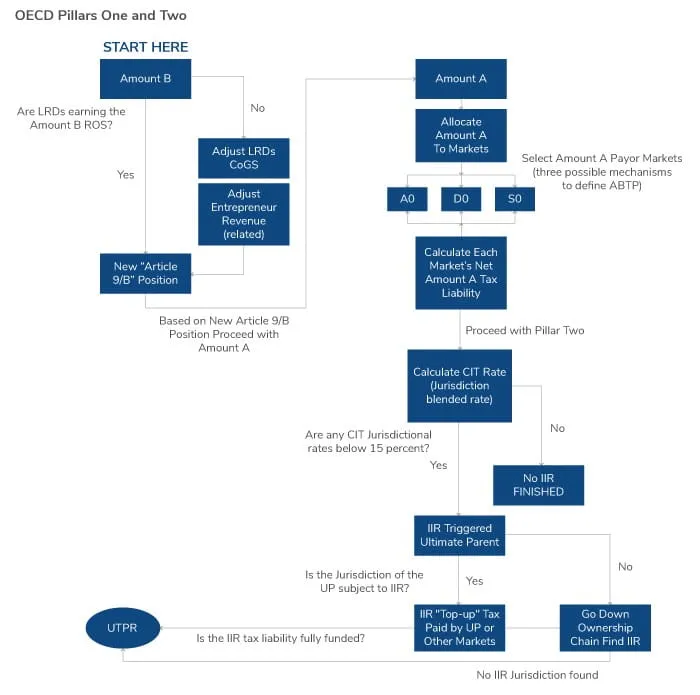

Pillar One's framework

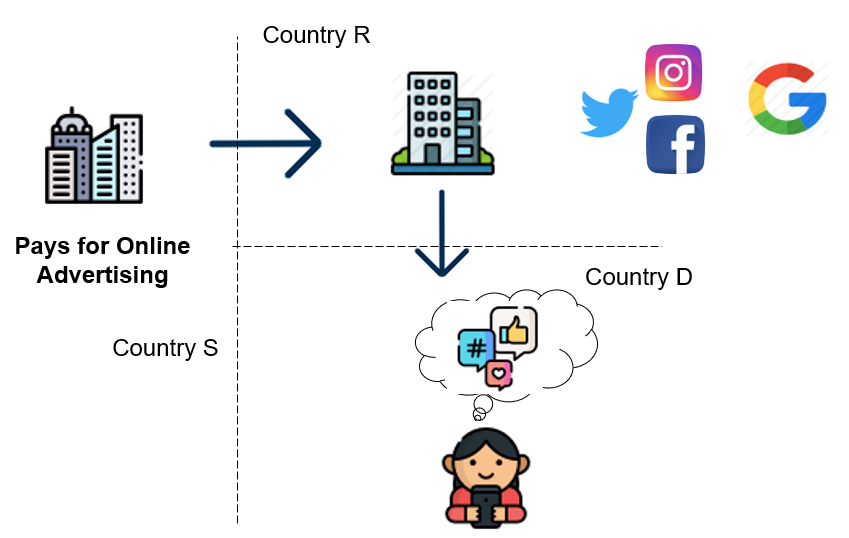

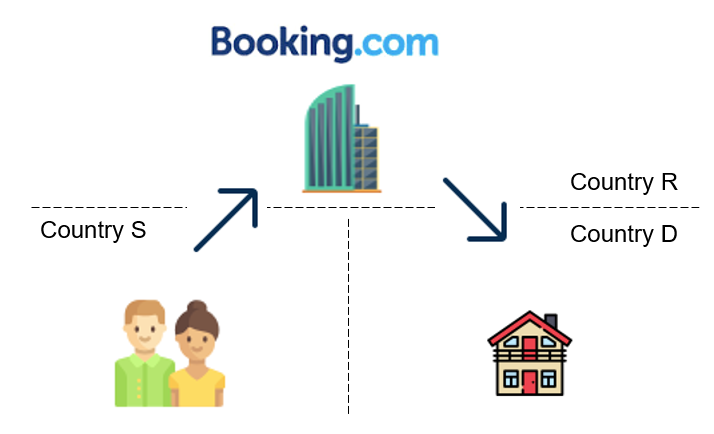

The UN Proposal on Automated Digital Services: Is It in the Interest of Developing Countries? - Kluwer International Tax Blog

A Practical Proposal to end Corporate Tax Abuse: METR, a Minimum Effective Tax Rate for Multinationals - Cobham - 2022 - Global Policy - Wiley Online Library

The UN Proposal on Automated Digital Services: Is It in the Interest of Developing Countries? - Kluwer International Tax Blog

F. Adapting the International Corporate Tax System to the Digitalisation of the Economy

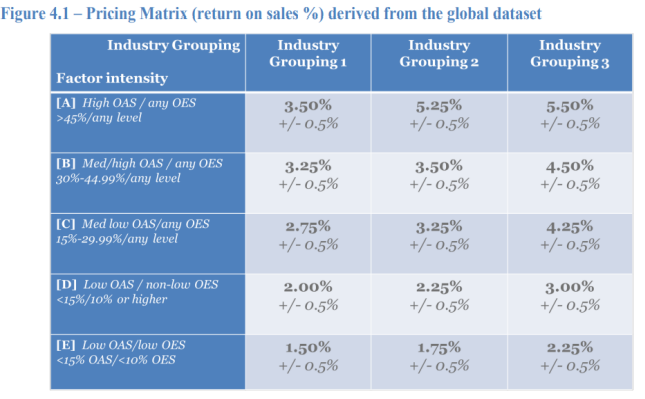

International: OECD issues new public consultation document on Amount B - Lexology

Search Results for: - ECOSCOPE

Submission on OECD Pillar One Amount A : Nexus and Revenue Sourcing Rules, nasscom

Deloitte tax@hand

Types of Group Taxation. Download Scientific Diagram

OECD's Pillar One Blueprint: Revenue Sourcing Rules

OECD Pillar Insight Simulation