:max_bytes(150000):strip_icc()/TermDefinitions_Stepupbasis-6fc33c446de546c7a4c63c41c4474cd2.jpg)

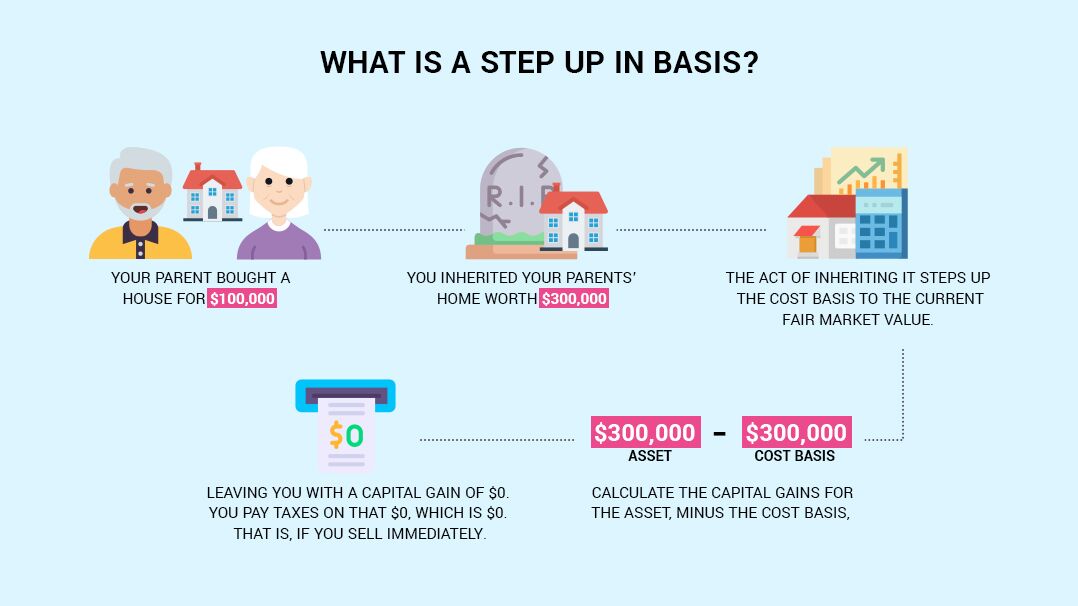

Step-Up in Basis: Definition, How It Works for Inherited Property

Understanding Step-Up in Basis for Assets Upon Inheritance

Taxes on inheritance & how to avoid them

Do Assets in a Living Trust Get a Step-Up in Basis? - Litherland, Kennedy & Associates, APC, Attorneys at Law

IRS confirms that completed gifts to grantor trusts are not eligible for Section 1014 step-up

What is a Step-Up in Basis and Does It Apply in San Diego?

Do You Pay Capital Gains Taxes on Property You Inherit?

Step-Up in Basis and Why It Matters in Estate Planning

What Is Step-Up In Basis? – Forbes Advisor

What are capital gains taxes and how could they be reformed?

The Step-Up in Basis for Real Estate Explained

IRS Publication 551: A Comprehensive Guide to Basis of Assets - FasterCapital

What is a Step-up in Basis? Cost Basis of Inherited Assets

:max_bytes(150000):strip_icc()/106338209-1--56a884bc5f9b58b7d0f30781.jpg)